The Impact of the Fiscal Cliff: Will it be avoided?

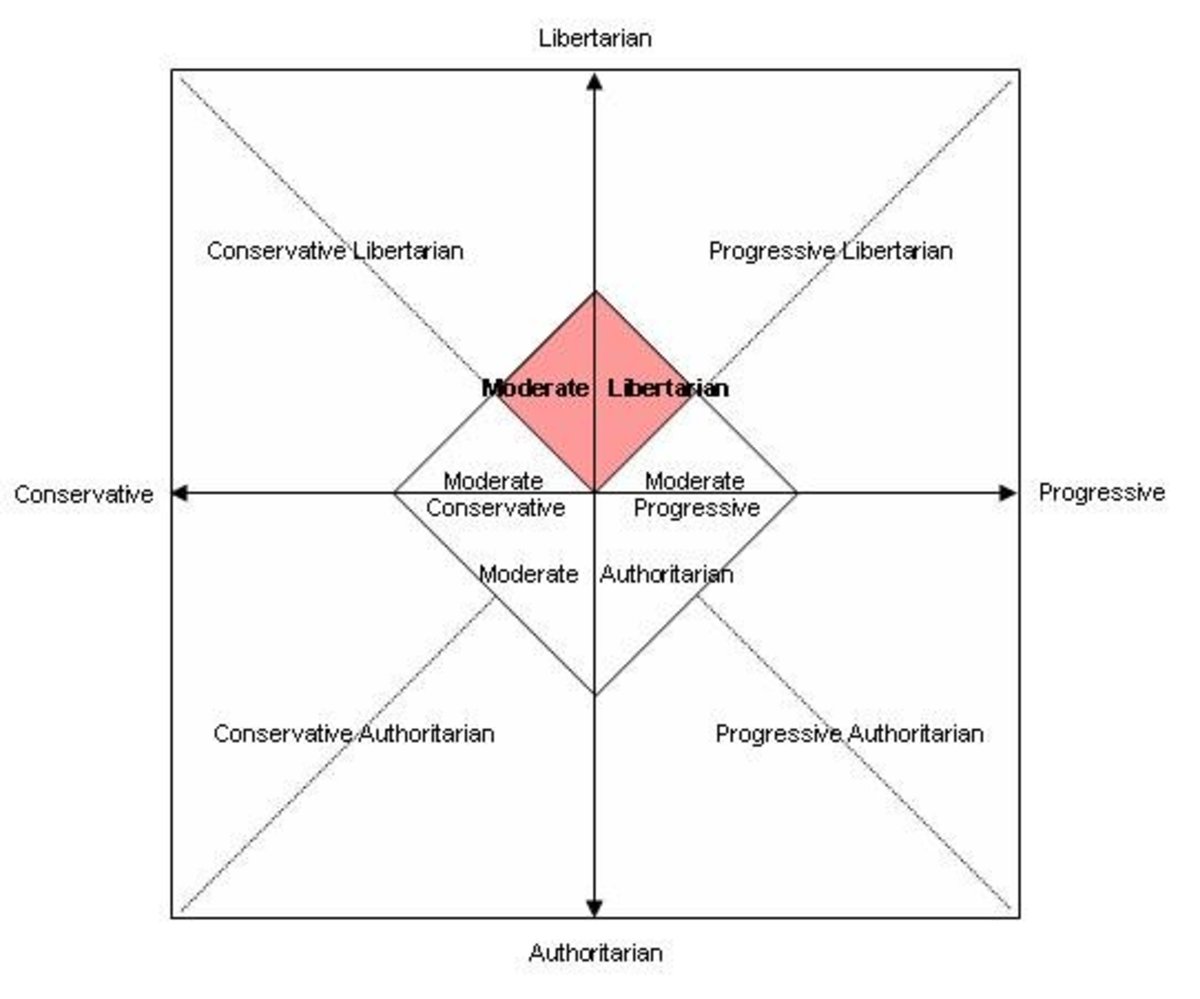

These economic times and the fiscal policy today and in the past have created a situation no elected official wants to take place. Avoiding the fiscal cliff as many in the media has reported is an event that will impact not only our country but countries around the world. We as a country must get our fiscal house in order. At the present time there appears to be a wide disagreement between what should be done between the political parties, it is time for both of them to come together to solve our fiscal dilemma. This is not meant to imply a criticism of one party or another as I believe there are good individuals with good intentions on both sides of the isle.

Our government has been spending more than it has been taking in for a number of years and both political parties are to blame. The culture in Washington needs to change and it will take some stepping up to the plate to address the critical issues involved which has caused and is causing our current fiscal crises. Many individuals I feel do not realize the impact if our country goes over the so called fiscal cliff. What really will be the impact and how can it be avoided is a question not easily answered.

First the deficit spending is out of control and has been for several years. The problem in real terms is the fact that the programs and laws in place costs money to operate, manage and enforce. The amount of money coming to the Treasury from tax revenue is not enough to cover the costs of these programs some of which are new and some have been around for years. One of the questions to be answered and probably never will be is whether these programs fall in line with the constitutional responsibilities of the federal government. Granted there are some critical programs and functions which may not necessarily be specifically identified as a federal government responsibility but they are the right place to manage. Some of these programs are typically referred to as entitlement programs. At the current rate the funds for these entitlement programs are going out will exceed the funds being received. This is a fact presented by many sources and investigations. When this will occur at this time is anyone’s guess as the timeframe is different dependent upon who is presenting the facts.

Understanding the impact and how it will affect us as individuals is difficult to put it in perspective as each of us will be impacted differently but the economy of our country will definitively take a turn for the worst if it occurs. All elected officials in Washington must address the needs of the country not their political philosophy. We have elected those to represent us to make good decisions for our country not their political party. What some may not understand is the fact if good decisions are made for our country it is good for their political party if they have been a part of or support these decisions. What must or should occur is each political party must balance their principles against the needs of the country. While this may be a difficult task to accomplish it is what is needed to put our fiscal house in order.

Getting into some specifics real spending needs to be cut and where the cuts will be made needs to be identified in any agreement to avoid the fiscal cliff. In arriving at this juncture the cuts made should consider what is necessary in relation to what is a nice thing to have. While this may raise some concerns as each politician will have different opinions on what is a necessity and what is a nice thing to have criteria needs to be established. It is important that the criteria developed be bi-partisan as to the criteria to measure the necessity of each program and also the necessity of the regulations associated with each program.

Another aspect involved in the projected fiscal cliff is the somewhat stagnant employment situation. What needs to occur is there needs to be a real effort to create an environment where employers feel it is in their best interest to hire and expand their business. The economic downturn of our economy and the world is causing less revenue for government operations. Making decisions today regarding increasing revenue to fund government operations should involve an examination of our history to determine what has worked and what has failed with respect to creating a growing economy. Granted there are certain aspects of our economy that has seen a rise of employment but the rise has not offset the negative of millions of individuals out of work.

The logical approach is to create an environment where businesses will know their expenses from year to year and can make plans associated with their business. Businesses will not expand in an uncertain environment where they do not know what their expenses will be from year to year. This needs to change. Each year laws and regulations are generated which cause heartaches for our business environment. The more people are working the more tax revenue will be received by the government to fund necessary programs. In these times it is a certain fact that tax increases will be a part of any agreement to address our fiscal cliff but the right tax decisions need to be made. Tax policy to some extent in general terms needs to be revamped while some specifics need to be identified as to what loopholes will be eliminated so the impact of the changes can be measured by GAO.

It is important that in any agreement to avoid the fiscal cliff that the right decisions will be made to ensure it will be avoided. In addition additional specifics regarding our tax structure needs to be identified so it is fair to all taxpayers. One option to consider is the fair tax system. The key is to revamp a tax structure that is cumbersome for individuals and businesses to totally understand without needing a lawyer. Granted some taxpayers do not need a lawyer but a taxpayer should not need a lawyer to file a tax return. The length of the tax regulations changes from year to year, it needs to be simplified and written in language any individual can understand. Granted our tax system is not directly affecting our fiscal cliff but it can have a positive effect by providing more incentives for individuals and businesses to expand and/or hire additional individuals. Our economy needs workers which will provide more revenue for the government. The extra income will help our deficit but spending should not be increased with any additional revenue a revamped tax system would provide.