Should individuals be denied or penalized to receive the benefits they have earned?

This is a topic which may not be on the radar screen as it can be controversial. We as individuals have earned benefits throughout our lives and the current economic times have created situations where benefits agreed to in contractual agreements are in jeopardy. This is not necessarily the fault of any of the parties which have made the agreements but the result of the economic downturn in the economy.

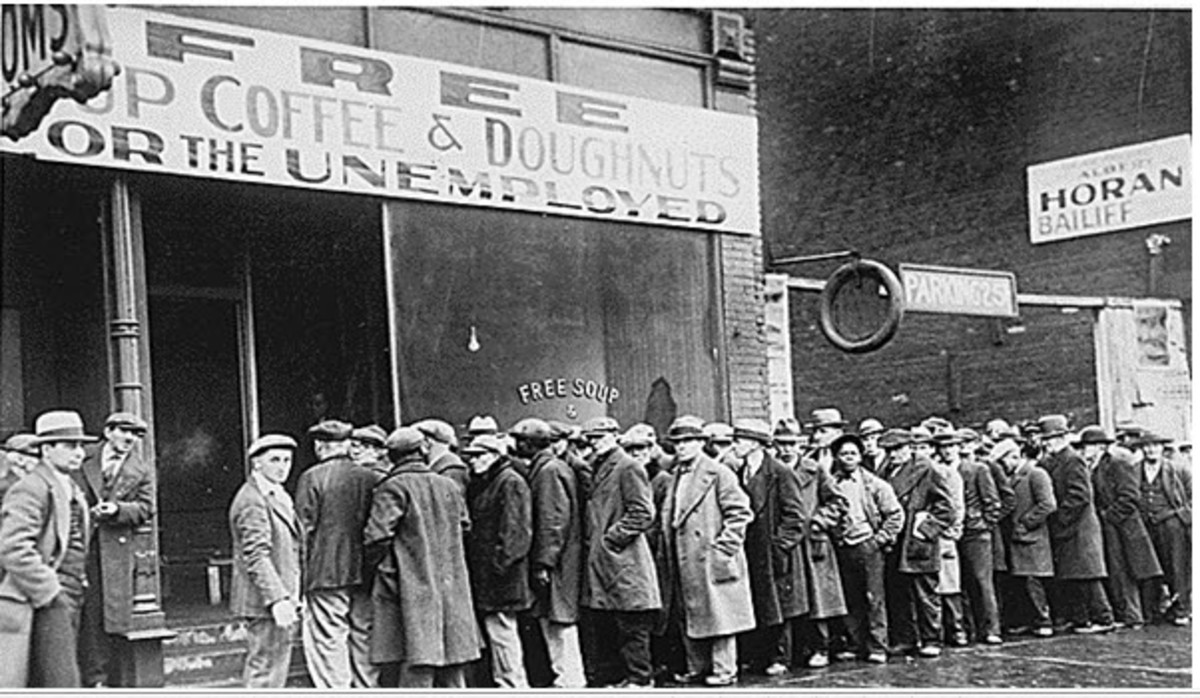

While there are those who are receiving benefits for which they have not earned it is not necessarily a bad thing as we as a country normally take care of our own. This is partly the reason why the economics of today is causing problems for individuals who have reached their elder years. One example involves Social Security benefits and the fact that individuals in the early 20th century did not pay as much into the fund as individuals of today. Social Security was not designed to be a complete income source but it has become just that for many individuals.

The process of Social Security as I understand it involves paying into the system through payroll deductions and payments by employers. When reaching retirement age as defined today with changes projected into the future you are eligible to receive monthly payments. In these economic times individuals are working longer and can receive their benefits while working. The problem which exists as I understand it is that individuals who are drawing Social Security payments are limited to how much they can earn without having their benefits reduced. The present system is in a financial bind for future recipients as there is not enough money in the system according to reports.

Many individuals have retirement plans from companies for which they have worked and in some cases their Social Security benefits which they have earned are limited in relation to the amount of pension they receive. Social Security benefits should not be reduced regardless of whether you have other income. It was not established as mentioned earlier to be the sole income of individuals after they retire. Another point to make is that after a certain age (70) Social Security benefits are not reduced. When reaching this age you can make as much as you want or can. This should apply to everyone not just at a certain age group.

Individuals who retire have enough problems in these economic times without their benefits being reduced simply for the fact they have other income. The problem with the funding of Social Security is not the individual’s fault that is drawing Social Security but how the fund has been managed over several presidential terms encompassing both political parties. Congress also has some responsibility in this respect. The problem now is fast approaching where measure will be needed to make hard changes to make the fund solvent now and into the future. Some changes have already been made such as raising the retirement age dependent upon when you were born. Other changes regarding the lack of money entering the fund to sustain the needed payments to what has been referred to as the baby boomers some of whom already draw Social Security benefits and others are fast approaching.

I am not making light of the problem with the Social Security but Washington has a spending problem and the spending problem is being pushed to the states by unfunded mandates. The spending culture of Washington must be changed to put us back on the road to financial solvency. Hard decisions must be made which Congress and the President in this and past administrations have not had the political tenacity to accomplish. Priorities must be established starting with what is required under the Constitution and what are nice to have things if funding is available. One point in all this involves the government living up to the contractual agreements on which it has entered. Funds to honor these agreements involve getting rid of unnecessary expenses which the government incurs each and every year. What these expenses are will be debatable however the criteria should be in line with government responsibilities.

The federal government has taken on more and more responsibilities and in some respects they make sense based on the structure to get the job done. Topics which are treated differently by each state may be good candidates unless under the Constitution it is a state responsibility. The philosophy of one size fits all may be a good one in some cases but when this philosophy is rampant across the board it can or will impact the daily activities of businesses, organizations and individuals. This philosophy also costs our tax dollars not only to generate this culture but to maintain and monitor it.

The dysfunctional Congress of today and it is dysfunctional in that it is difficult to get things done in a way which addresses the problems of our country. It is not about pointing blame as there is enough to go around. The American people are at a point where our fiscal house needs to be put on a path to fiscal responsibility. Something that is never mentioned involves the fact that we the public is the holder of the highest amount of public debt. Research indicates that the holder of the largest amount of debt is us with the Social Security fund being owed over 11 trillion dollars. Another disturbing fact whether true or not is that when federal agencies have more money than they need right now they buy U.S. treasury bonds. One question which needs to be answered if this is true is why funds are being allocated to agencies they do not need causing the debt to increase. When we as individuals buy U.S. Treasury bonds this increases the national debt. I am not suggesting that we should stop buy the treasury bonds. The Social Security Trust fund must be made solvent and when this occurs our national debt would be reduced by over 11 trillion. If you think about it this may or would cause a big influx of confidence in the economy.

Those of us who have retirement funds which we have paid into should never have our benefits which we have earned be denied or reduced. Individuals should be able to get their retirement checks and Social Security checks if they have been earned each month disregarding the fact that other income is being received. Some may consider this to be double dipping but the benefits have been earned. Granted there are limited funds at this juncture in our economy and some may say that wealthy individuals should not receive Social Security funds. This is a choice that these individuals must make not the government. Some retirement funds have had financial problems in the private sector and the result is that some individuals have lost that financial support. The funds have not been managed well just like the Social Security Trust fund. It is time to stop the political culture of kicking the can down the road to avoid addressing the financial issues of the public debt and make the decisions which must be made to put our fiscal house in order.